Affordable Housing Basics

I qualified to live in an affordable housing unit, so why do my rents continue to go up?

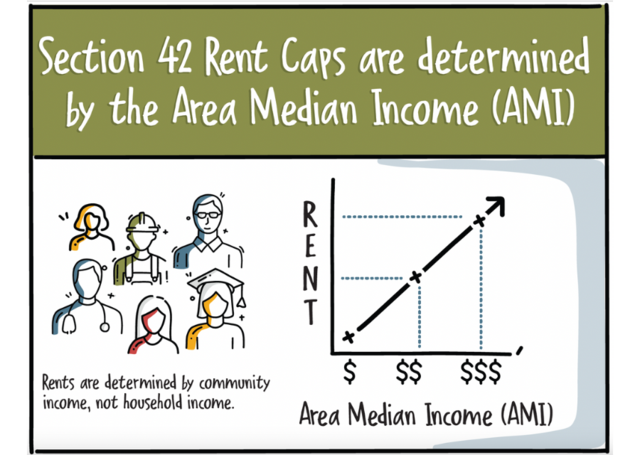

Your apartment was financed through the Low-Income Housing Tax Credit (LIHTC) program, also known as Section 42. Section 42 rents are not based on your income. Instead, rent is capped by rules that are tied to the apartment. This means that your rent will not change even if your income significantly increases or decreases. However, rent will increase along with the Area Median Income (AMI). Rents are not allowed to increase faster than the AMI, and over time, Section 42 rents remain at 30% of the AMI for each apartment.

Area Median Income means half of the families in a region earn more than the median and half earn less than the median. The U.S. Department of Housing and Urban Development (HUD) calculates different levels of AMI for geographic areas across the country by household size.

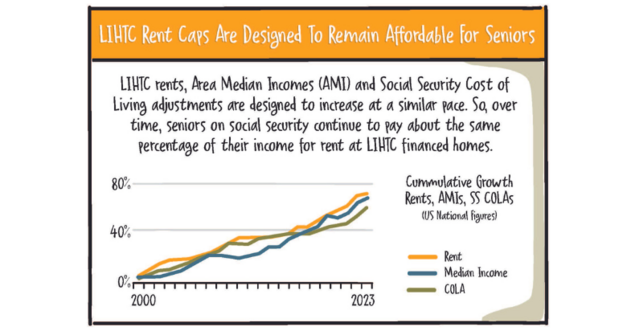

What if I’m a senior citizen and my income doesn’t go up at the same rate as the area median income where I live?

LIHTC rents (based on AMI) and Social Security Cost of Living Adjustments (COLA) and the Consumer Price Index (CPI, a common measure of inflation), move at approximately the same rate over time. This provides rent control for LIHTC apartments – even for renters on fixed incomes because their incomes go up at roughly the same rate as rents. This connection between rent levels and inflation also helps keep properties in good repair and sustains the affordability for long periods of time.

Why is my rental apartment considered affordable housing if I might not always be able to afford it?

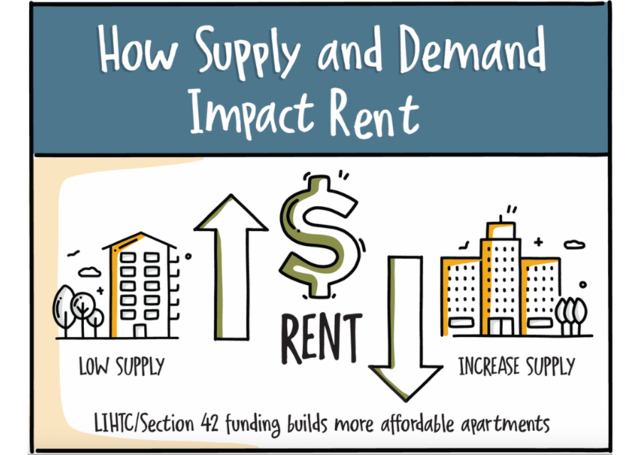

The goal of the Section 42 program is to encourage more private development of quality housing units to address the severe shortage of affordable homes available in the United States. The rent levels are tied to the community’s median incomes (AMI) rather than each renter’s income.

The program works. Section 42 has helped build more than 3 million housing units since it was established in 1986. Creating more housing for people with middle to low incomes drives down housing costs overall, by providing more housing supply to meet demand.

Additionally, Section 42 rules ensure that the buildings are well-maintained. Rents tied to AMI allow building management to maintain and preserve quality apartments buildings. If rents are artificially capped, building owners and manager lack sufficient funding to maintain the properties.

What can I do if I can no longer afford my rent?

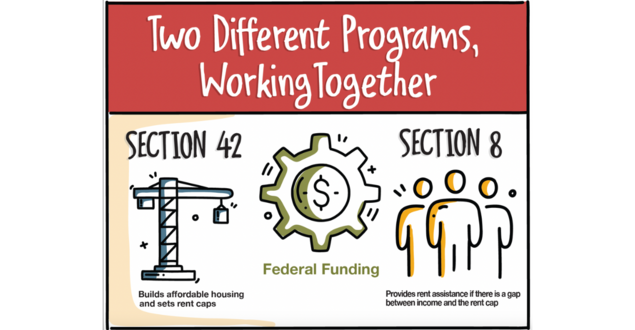

The federal government has another affordable housing program that is meant to help people when they can’t afford rent. This rental assistance is known as housing choice vouchers, or Section 8 vouchers. These vouchers provide rental assistance to ensure that people with modest incomes don’t pay more than 30% of their income on housing. Vouchers are available through the local housing authority or county. There are also a variety of other community and charitable programs that can help people with lower incomes meet their rent, housing costs, and other basic living needs.

What the Experts Say

Underproduction Totals in Key States